For a background on Galaxy Resources ("Galaxy") investors can read my previous articles:

June 22, 2016 - Galaxy Resources - An Excellent Way To Invest Into The Lithium Miners. August 22, 2016 - Galaxy Resources Is An Outstanding Buy After Its Recent 20% Fall. October 3, 2017 - Will Galaxy Resources Be Next With Some Good News?

Note: Since the above articles Galaxy did a 5:1 share consolidation. Therefore the stock prices quoted in the above articles need to be multiplied by 5x to compare to the current stock price.

Galaxy Resources [ASX:GXY] (OTCPK:GALXF) - Price = AUD 3.42

Galaxy Resources is an Australian pure play lithium miner with 3 lithium projects globally.

Galaxy Resources 5 year price graph

Source: Bloomberg

Galaxy Resources three lithium projects (all 100% owned) Mt Cattlin Australia (lithium spodumene producer) Sal De Vida Argentina (lithium brine project) James Bay Canada (lithium spodumene project)

Note: From here on I will focus on the Sal De Vida project in Argentina.

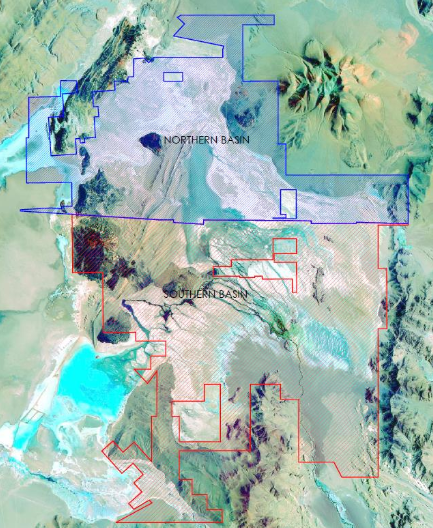

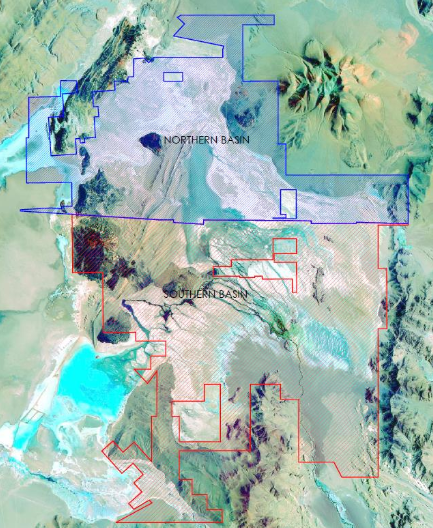

The Sal De Vida [SDV] project

Sal De Vida - location map

Source

Galaxy Resources Sal De Vida resources

Prior to the sale to POSCO Galaxy had announced a total Lithium Carbonate Equivalent [LCE] resource at Sal De Vida of 7.23m tonnes contained lithium (at a lithium grade of 780mg/L), or 1.14 million tonnes of contained LCE reserves.

After the sale of the northern tenements to POSCO the total resource estimate falls to 4.09 million tonnes LCE as Galaxy retains the southern tenements. The reserves estimate remains unchanged. See below.

The POSCO deal

On May 29 Galaxy Resources announced, "Galaxy agrees to sell northern tenement package at Sal De Vida for US$280 million to POSCO. Galaxy retains 100% of the tenements in the southern area of Salar del Hombre Muerto in the Catamarca Province included in the recently announced updated feasibility study for the development of Sal de Vida. The southern tenements contain an estimated 4.09million tonnes LCE of JORC compliant measured and indicated resource and 100% of the current 1.14 million tonnes LCE of JORC compliant reserves."

Note: The Sal De Vida salar is part of the Salar del Hombre Muerto.

SDV tenements map - Blue sold to POSCO, and red retained by Galaxy

Source

The key point to note here is that Galaxy Resources retains a large enough section of Sal De Vida (1.14 million tonnes LCE) that they can still produce about 25ktpa LCE over a 40 year mine life, and the Feasibility Study [FS] conclusions (post tax NPV8% of US$1.48 billion) are not impacted at all. Galaxy gets an enormous cash boost that can greatly help fund their SDV development with no need for a project partner.

Infrastructure and access

Access and infrastructure are good as FMC Corp. (FMC) has been producing in the salar since 1997.

Management

Martin Rowley - Independent Non Executive Chairman

Mr Rowley was a co-founder of TSX and LSE-listed First Quantum Minerals Ltd and is currently that company��s Executive Director, Business Development. First Quantum is one of the world's largest copper production companies and the owner of the Ravensthorpe nickel project in Western Australia with a market capitalisation of in excess of A$10 billion. He was previously non-executive Chairman and director of Lithium One Inc., which was acquired by Galaxy by way of a Plan of Arrangement in July 2012. He is also non-executive Chairman and a director of Forsys Metals Corp, a TSX-listed company in the uranium sector.

Anthony Tse - Managing Director

Mr Tse has 20 years of corporate experience in numerous high-growth industries such as technology, internet/mobile, media & entertainment, and resource & commodities �� primarily in senior management, capital markets and M&A roles across Greater China and Asia Pacific in general. His previous management roles include various positions in News Corporation's STAR TV, the Deputy General Manager of TOM Online, Director of Corporate Development at Hutchison Whampoa's TOM Group, President of China Entertainment Television (a joint venture between TOM and Time Warner), and CEO of CSN Corp. He is a Fellow of the Hong Kong Institute of Directors (HKIoD) and a member of the Hong Kong Mining Investment Professionals Association (HKMIPA).

Brian Talbot B.Sc Eng. (Hons) - Chief Operations Officer

Mr Talbot has over 25 years�� experience in mining and minerals processing operations and holds a bachelor��s degree in chemical engineering with Honours. Mr Talbot was previously Galaxy��s General Manager where he has managed the Mt Cattlin mine site increasing production to above plan design. Prior to joining Galaxy he was at Bikita Minerals, a lithium mine in Zimbabwe where he achieved increased product yield and capacity. Mr Talbot has also held the positions of mining company director, general manager and metallurgist at various mine operations in Egypt and South Africa with diverse experience in designing, planning and managing profitable mining operations.

You can read more here.

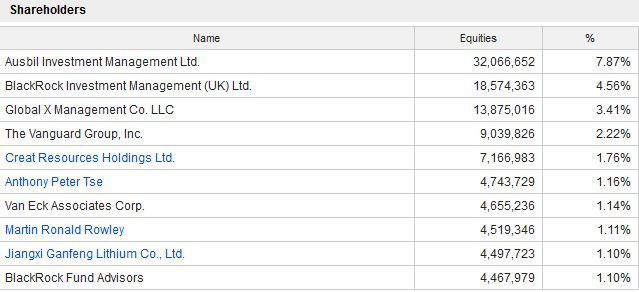

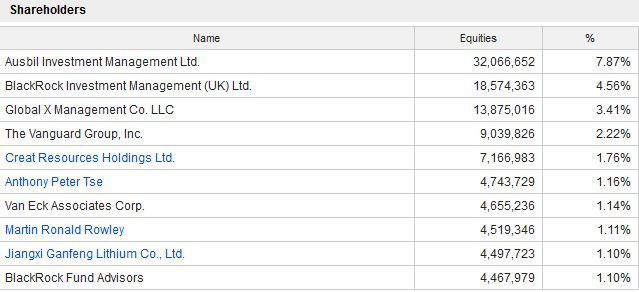

Largest Shareholders

Source

Note: Insider ownership should increase as options are converted to shares if performance targets are met. A strong level of institutional ownership.

Sal De Vida PFS

On May 15, 2018 Galaxy reported: "Sal de Vida - Updated Feasibility Study." Highlights include:

"Results from the updated feasibility study for the Sal de Vida Project validate a technically superior, highly profitable, long life (40 years) and low-cost lithium and potash project. Post-tax Net Present Value ("NPV") of US$1.48 billion at an 8% discount rate (real). Post-tax Internal Rate of Return ("IRR") of 26.9%, with post-tax payback period of approximately 3 years from first production. Capital cost estimate of US$474million, including US$31million for an optional potash production circuit. Operating costs at full production of US$3,144 per tonne of lithium carbonate after potash credits. Average annual revenues of US$360 million and EBITDA of US$270 million. JORC-compliant reserve estimate of 1.1 million tonnes of recoverable lithium carbonate equivalent ("LCE"), supports a long initial project life with 25ktpa of lithium carbonate and 94ktpa of potash production respectively." Valuation

Galaxy Resources has no debt and cash as at 31 December 2017 of AUD 59.7m. Current market cap is AUD 1.39b.

My recently updated price target (assuming the US$ 280m POSCO deal goes through) for end 2021 is AUD 5.90 or ~1.7x higher, based on Mt Catlin (250ktpa spodumene) and Sal de Vida (15ktpa LCE) being in production. Assumes a cost of production of USD 3,144/t LCE for brine (USD 320/t spodumene) and a selling price of USD 12,000/t LCE for brine (USD 900/t spodumene). Assumes a CapEx of USD 474m to get SDV to production.

Note: My model suggests SDV can be fully funded by Galaxy from retained earnings and the POSCO deal monies.

By 2023/2024 my price target increases to AUD 11.83 or ~3.5x higher, based on Mt Catlin (250ktpa spodumene), Sal de Vida (25ktpa LCE), and James Bay (250ktpa spodumene) all being in production. Assumes the same costs and selling prices as above. Galaxy would then be an AUD 4.6b market cap lithium pure play global leader.

Current analyst consensus estimates for Galaxy Resources is AUD 4.15 or 17% upside. I would assume the analysts have not yet factored in the POSCO deal, as the deal has not yet finalized. Once it finalizes I would expect a significant target increase closer to AUD 5.00.

Catalysts Q3, 2018 - POSCO deal due to complete. Q3, 2018 - The FMC lithium IPO should give a boost to Galaxy's SDV project valuation being located nearby. 2018 - Mt Cattlin resource upgrade. James Bay Feasibility Study. 2018/19 - Announcements to commence construction of Sal De Vida. 2020/21 - Sal De Vida production to begin. Competitors For coverage of the lithium miner competitors investors can view my articles "Lithium Miners News For The Month Of May 2018", and "Lithium Junior Miner News For The Month Of May 2018." Risks Lithium prices falling. My model does forecast a possible mild lithium oversupply in 2019/2020 as does Benchmark Minerals recent analysis. The electric vehicle [EV] boom and energy storage boom may not continue. Technology change may replace lithium in the battery. Very unlikely The usual mining risks - Exploration risks, funding risks, permitting risks, production risks. As discussed funding risk at SDV will shortly be gone. Management and currency risks. Sovereign risk is medium in Argentina and low in Australia and Canada. Stock market risks - Dilution, lack of liquidity (best to buy on local exchange), market sentiment.

Investors can view the company presentation here.

Conclusion

Galaxy Resources has had a good run the past 3-4 years. Assuming the recent POSCO deal goes through the stock will re-rate significantly higher. In fact, my modeling shows Galaxy will no longer need any funding whatsoever to develop Sal De Vida, nor will they need a project partner. This is highly significant in several ways. Firstly it de-risks the Sal De Vida project from a funding perspective, and also allows Galaxy to retain 100% ownership should they choose. Secondly the USD 280m of cash massively strengthens Galaxy's already strong balance sheet which de-risks the Company as a whole.

The magic of the POSCO deal for Galaxy and Galaxy shareholders is that the Sal De Vida project economics are not affected, SDV can still have a superb 40 year production life, and the Feasibility Study NPV of USD 1.48b is also completely unchanged. Clearly management at Galaxy has pulled another rabbit from their magical hat.

Given the deal is highly likely to go through investors have just a short window to get onboard before analysts upgrade their targets.

As usual all comments are welcome.

Trend Investing

Thanks for reading the article. If you want to go to the next level, sign up for Trend Investing, my Marketplace service. I share my best investing ideas and latest articles on the latest trends. You will also get access to exclusive CEO interviews and chat room access to me, and to other sophisticated investors. You can benefit from the hundreds of hours of work I've done to analyze the best opportunities in emerging industries, especially the electric vehicle and EV metals sector. You can learn more by reading "The Trend Investing Difference", "Recent Subscriber Feedback On Trend Investing", or sign up here.

My latest related Trend Investing articles are:

An Update On Pilbara Minerals Investing Well - July 2018 An Update On Cobalt Blue

Disclosure: I am/we are long GALAXY RESOURCES [ASX:GXY].

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information in this article is general in nature and should not be relied upon as personal financial advice.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Brink’s (NYSE:BCO) was downgraded by Zacks Investment Research from a “hold” rating to a “sell” rating in a research note issued to investors on Friday.

Brink’s (NYSE:BCO) was downgraded by Zacks Investment Research from a “hold” rating to a “sell” rating in a research note issued to investors on Friday.  Peter Krauth

Peter Krauth

Spok Holdings, Inc., through its subsidiary, Spok, Inc., provides various communications solutions to healthcare, government, and other enterprises in the United States, Europe, Canada, Australia, Asia, and the Middle East. The company provides one-way messaging, including numeric messaging services, which enable subscribers to receive messages comprising numbers, such as phone numbers; and alphanumeric messages, including numbers and letters that enable subscribers to receive text messages. It also offers two-way messaging services that enable subscribers to send and receive messages to and from other wireless messaging devices, such as pagers, personal digital assistants, and personal computers; and voice mail, personalized greeting, message storage and retrieval, and equipment loss and/or maintenance protection to one-way and two-way messaging subscribers. In addition, the company develops, sells, and supports enterprise-wide systems to automate, centralize, and standardize mission critical communications for contact centers, clinical alerting and notification, mobile communications, and messaging, as well as for public safety notifications. Further, it sells devices to resellers who lease or resell them to their subscribers; ancillary services, such as voicemail and equipment loss or maintenance protection, as well as provides a suite of professional services. The company serves businesses, professionals, management personnel, medical personnel, field sales personnel and service forces, members of the construction industry and construction trades, real estate brokers and developers, sales and services organizations, specialty trade organizations, manufacturing organizations, and government agencies. The company was formerly known as USA Mobility, Inc. and changed its name to Spok Holdings, Inc. in July 2014. Spok Holdings, Inc. is headquartered in Springfield, Virginia.

Spok Holdings, Inc., through its subsidiary, Spok, Inc., provides various communications solutions to healthcare, government, and other enterprises in the United States, Europe, Canada, Australia, Asia, and the Middle East. The company provides one-way messaging, including numeric messaging services, which enable subscribers to receive messages comprising numbers, such as phone numbers; and alphanumeric messages, including numbers and letters that enable subscribers to receive text messages. It also offers two-way messaging services that enable subscribers to send and receive messages to and from other wireless messaging devices, such as pagers, personal digital assistants, and personal computers; and voice mail, personalized greeting, message storage and retrieval, and equipment loss and/or maintenance protection to one-way and two-way messaging subscribers. In addition, the company develops, sells, and supports enterprise-wide systems to automate, centralize, and standardize mission critical communications for contact centers, clinical alerting and notification, mobile communications, and messaging, as well as for public safety notifications. Further, it sells devices to resellers who lease or resell them to their subscribers; ancillary services, such as voicemail and equipment loss or maintenance protection, as well as provides a suite of professional services. The company serves businesses, professionals, management personnel, medical personnel, field sales personnel and service forces, members of the construction industry and construction trades, real estate brokers and developers, sales and services organizations, specialty trade organizations, manufacturing organizations, and government agencies. The company was formerly known as USA Mobility, Inc. and changed its name to Spok Holdings, Inc. in July 2014. Spok Holdings, Inc. is headquartered in Springfield, Virginia. Public Joint-Stock Company Mobile TeleSystems provides telecommunication services in Russia, Ukraine, Turkmenistan, and Armenia. The company operates through three segments: Russia Convergent, Moscow Fixed Line, and Ukraine. It offers voice and data transmission, Internet access, pay TV, and various value added services through wireless and fixed lines, as well as sells equipment, accessories, and handsets. The company also provides system integration services and IT solutions. Public Joint-Stock Company Mobile TeleSystems has a partnership agreement with Nokia for joint development and deployment of Nokia's new technological solutions, as well as to promote new digital products and services of Mobile TeleSystems Group. The company was founded in 1993 and is based in Moscow, Russia. Public Joint-Stock Company Mobile TeleSystems is a subsidiary of Sistema Finance S.A.

Public Joint-Stock Company Mobile TeleSystems provides telecommunication services in Russia, Ukraine, Turkmenistan, and Armenia. The company operates through three segments: Russia Convergent, Moscow Fixed Line, and Ukraine. It offers voice and data transmission, Internet access, pay TV, and various value added services through wireless and fixed lines, as well as sells equipment, accessories, and handsets. The company also provides system integration services and IT solutions. Public Joint-Stock Company Mobile TeleSystems has a partnership agreement with Nokia for joint development and deployment of Nokia's new technological solutions, as well as to promote new digital products and services of Mobile TeleSystems Group. The company was founded in 1993 and is based in Moscow, Russia. Public Joint-Stock Company Mobile TeleSystems is a subsidiary of Sistema Finance S.A. News stories about Norbord (NYSE:OSB) have been trending somewhat positive recently, according to Accern. Accern identifies negative and positive media coverage by analyzing more than twenty million news and blog sources in real-time. Accern ranks coverage of publicly-traded companies on a scale of negative one to one, with scores closest to one being the most favorable. Norbord earned a daily sentiment score of 0.05 on Accern’s scale. Accern also assigned news articles about the construction company an impact score of 45.5014696096595 out of 100, indicating that recent media coverage is somewhat unlikely to have an impact on the company’s share price in the immediate future.

News stories about Norbord (NYSE:OSB) have been trending somewhat positive recently, according to Accern. Accern identifies negative and positive media coverage by analyzing more than twenty million news and blog sources in real-time. Accern ranks coverage of publicly-traded companies on a scale of negative one to one, with scores closest to one being the most favorable. Norbord earned a daily sentiment score of 0.05 on Accern’s scale. Accern also assigned news articles about the construction company an impact score of 45.5014696096595 out of 100, indicating that recent media coverage is somewhat unlikely to have an impact on the company’s share price in the immediate future.  Johnson Matthey (LON:JMAT) had its price target boosted by Berenberg Bank from GBX 3,680 ($48.99) to GBX 4,300 ($57.25) in a research report sent to investors on Tuesday morning. They currently have a buy rating on the stock.

Johnson Matthey (LON:JMAT) had its price target boosted by Berenberg Bank from GBX 3,680 ($48.99) to GBX 4,300 ($57.25) in a research report sent to investors on Tuesday morning. They currently have a buy rating on the stock.