For a background on Galaxy Resources ("Galaxy") investors can read my previous articles:

June 22, 2016 - Galaxy Resources - An Excellent Way To Invest Into The Lithium Miners. August 22, 2016 - Galaxy Resources Is An Outstanding Buy After Its Recent 20% Fall. October 3, 2017 - Will Galaxy Resources Be Next With Some Good News?

Note: Since the above articles Galaxy did a 5:1 share consolidation. Therefore the stock prices quoted in the above articles need to be multiplied by 5x to compare to the current stock price.

Galaxy Resources [ASX:GXY] (OTCPK:GALXF) - Price = AUD 3.42

Galaxy Resources is an Australian pure play lithium miner with 3 lithium projects globally.

Galaxy Resources 5 year price graph

Source: Bloomberg

Galaxy Resources three lithium projects (all 100% owned) Mt Cattlin Australia (lithium spodumene producer) Sal De Vida Argentina (lithium brine project) James Bay Canada (lithium spodumene project)

Note: From here on I will focus on the Sal De Vida project in Argentina.

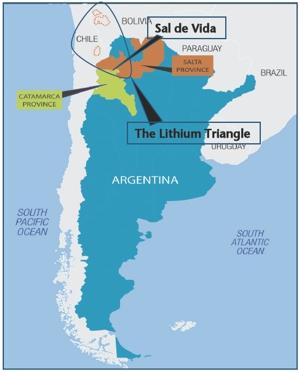

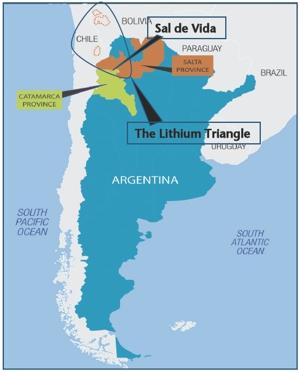

The Sal De Vida [SDV] project

Sal De Vida - location map

Source

Galaxy Resources Sal De Vida resources

Prior to the sale to POSCO Galaxy had announced a total Lithium Carbonate Equivalent [LCE] resource at Sal De Vida of 7.23m tonnes contained lithium (at a lithium grade of 780mg/L), or 1.14 million tonnes of contained LCE reserves.

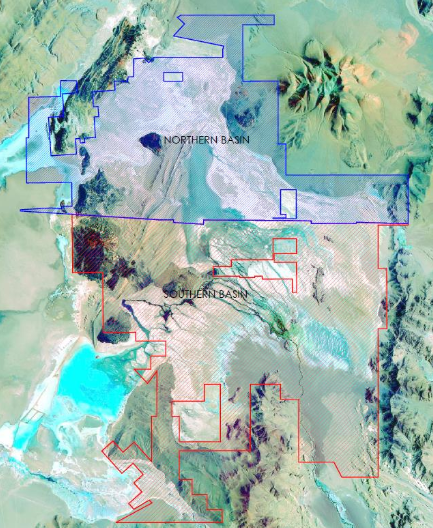

After the sale of the northern tenements to POSCO the total resource estimate falls to 4.09 million tonnes LCE as Galaxy retains the southern tenements. The reserves estimate remains unchanged. See below.

The POSCO deal

On May 29 Galaxy Resources announced, "Galaxy agrees to sell northern tenement package at Sal De Vida for US$280 million to POSCO. Galaxy retains 100% of the tenements in the southern area of Salar del Hombre Muerto in the Catamarca Province included in the recently announced updated feasibility study for the development of Sal de Vida. The southern tenements contain an estimated 4.09million tonnes LCE of JORC compliant measured and indicated resource and 100% of the current 1.14 million tonnes LCE of JORC compliant reserves."

Note: The Sal De Vida salar is part of the Salar del Hombre Muerto.

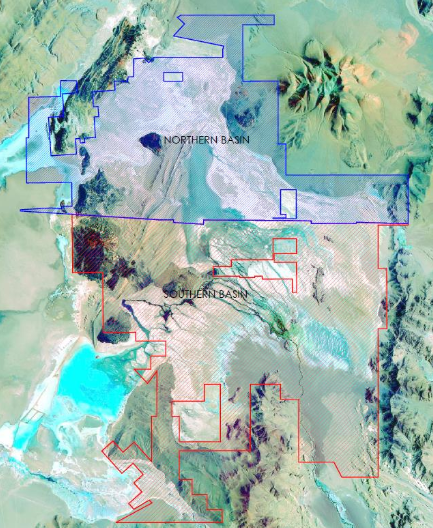

SDV tenements map - Blue sold to POSCO, and red retained by Galaxy

Source

The key point to note here is that Galaxy Resources retains a large enough section of Sal De Vida (1.14 million tonnes LCE) that they can still produce about 25ktpa LCE over a 40 year mine life, and the Feasibility Study [FS] conclusions (post tax NPV8% of US$1.48 billion) are not impacted at all. Galaxy gets an enormous cash boost that can greatly help fund their SDV development with no need for a project partner.

Infrastructure and access

Access and infrastructure are good as FMC Corp. (FMC) has been producing in the salar since 1997.

Management

Martin Rowley - Independent Non Executive Chairman

Mr Rowley was a co-founder of TSX and LSE-listed First Quantum Minerals Ltd and is currently that company��s Executive Director, Business Development. First Quantum is one of the world's largest copper production companies and the owner of the Ravensthorpe nickel project in Western Australia with a market capitalisation of in excess of A$10 billion. He was previously non-executive Chairman and director of Lithium One Inc., which was acquired by Galaxy by way of a Plan of Arrangement in July 2012. He is also non-executive Chairman and a director of Forsys Metals Corp, a TSX-listed company in the uranium sector.

Anthony Tse - Managing Director

Mr Tse has 20 years of corporate experience in numerous high-growth industries such as technology, internet/mobile, media & entertainment, and resource & commodities �� primarily in senior management, capital markets and M&A roles across Greater China and Asia Pacific in general. His previous management roles include various positions in News Corporation's STAR TV, the Deputy General Manager of TOM Online, Director of Corporate Development at Hutchison Whampoa's TOM Group, President of China Entertainment Television (a joint venture between TOM and Time Warner), and CEO of CSN Corp. He is a Fellow of the Hong Kong Institute of Directors (HKIoD) and a member of the Hong Kong Mining Investment Professionals Association (HKMIPA).

Brian Talbot B.Sc Eng. (Hons) - Chief Operations Officer

Mr Talbot has over 25 years�� experience in mining and minerals processing operations and holds a bachelor��s degree in chemical engineering with Honours. Mr Talbot was previously Galaxy��s General Manager where he has managed the Mt Cattlin mine site increasing production to above plan design. Prior to joining Galaxy he was at Bikita Minerals, a lithium mine in Zimbabwe where he achieved increased product yield and capacity. Mr Talbot has also held the positions of mining company director, general manager and metallurgist at various mine operations in Egypt and South Africa with diverse experience in designing, planning and managing profitable mining operations.

You can read more here.

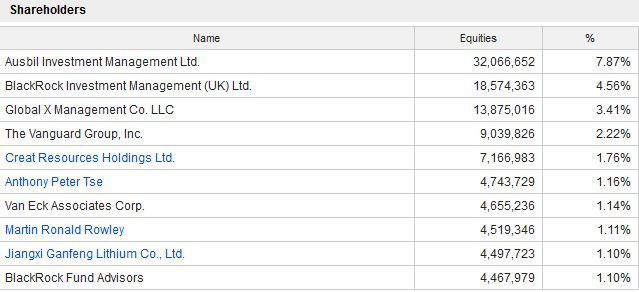

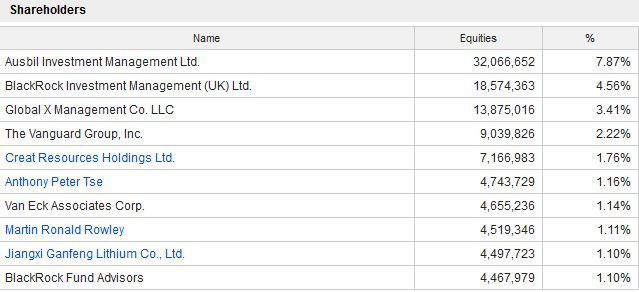

Largest Shareholders

Source

Note: Insider ownership should increase as options are converted to shares if performance targets are met. A strong level of institutional ownership.

Sal De Vida PFS

On May 15, 2018 Galaxy reported: "Sal de Vida - Updated Feasibility Study." Highlights include:

"Results from the updated feasibility study for the Sal de Vida Project validate a technically superior, highly profitable, long life (40 years) and low-cost lithium and potash project. Post-tax Net Present Value ("NPV") of US$1.48 billion at an 8% discount rate (real). Post-tax Internal Rate of Return ("IRR") of 26.9%, with post-tax payback period of approximately 3 years from first production. Capital cost estimate of US$474million, including US$31million for an optional potash production circuit. Operating costs at full production of US$3,144 per tonne of lithium carbonate after potash credits. Average annual revenues of US$360 million and EBITDA of US$270 million. JORC-compliant reserve estimate of 1.1 million tonnes of recoverable lithium carbonate equivalent ("LCE"), supports a long initial project life with 25ktpa of lithium carbonate and 94ktpa of potash production respectively." Valuation

Galaxy Resources has no debt and cash as at 31 December 2017 of AUD 59.7m. Current market cap is AUD 1.39b.

My recently updated price target (assuming the US$ 280m POSCO deal goes through) for end 2021 is AUD 5.90 or ~1.7x higher, based on Mt Catlin (250ktpa spodumene) and Sal de Vida (15ktpa LCE) being in production. Assumes a cost of production of USD 3,144/t LCE for brine (USD 320/t spodumene) and a selling price of USD 12,000/t LCE for brine (USD 900/t spodumene). Assumes a CapEx of USD 474m to get SDV to production.

Note: My model suggests SDV can be fully funded by Galaxy from retained earnings and the POSCO deal monies.

By 2023/2024 my price target increases to AUD 11.83 or ~3.5x higher, based on Mt Catlin (250ktpa spodumene), Sal de Vida (25ktpa LCE), and James Bay (250ktpa spodumene) all being in production. Assumes the same costs and selling prices as above. Galaxy would then be an AUD 4.6b market cap lithium pure play global leader.

Current analyst consensus estimates for Galaxy Resources is AUD 4.15 or 17% upside. I would assume the analysts have not yet factored in the POSCO deal, as the deal has not yet finalized. Once it finalizes I would expect a significant target increase closer to AUD 5.00.

Catalysts Q3, 2018 - POSCO deal due to complete. Q3, 2018 - The FMC lithium IPO should give a boost to Galaxy's SDV project valuation being located nearby. 2018 - Mt Cattlin resource upgrade. James Bay Feasibility Study. 2018/19 - Announcements to commence construction of Sal De Vida. 2020/21 - Sal De Vida production to begin. Competitors For coverage of the lithium miner competitors investors can view my articles "Lithium Miners News For The Month Of May 2018", and "Lithium Junior Miner News For The Month Of May 2018." Risks Lithium prices falling. My model does forecast a possible mild lithium oversupply in 2019/2020 as does Benchmark Minerals recent analysis. The electric vehicle [EV] boom and energy storage boom may not continue. Technology change may replace lithium in the battery. Very unlikely The usual mining risks - Exploration risks, funding risks, permitting risks, production risks. As discussed funding risk at SDV will shortly be gone. Management and currency risks. Sovereign risk is medium in Argentina and low in Australia and Canada. Stock market risks - Dilution, lack of liquidity (best to buy on local exchange), market sentiment.

Investors can view the company presentation here.

Conclusion

Galaxy Resources has had a good run the past 3-4 years. Assuming the recent POSCO deal goes through the stock will re-rate significantly higher. In fact, my modeling shows Galaxy will no longer need any funding whatsoever to develop Sal De Vida, nor will they need a project partner. This is highly significant in several ways. Firstly it de-risks the Sal De Vida project from a funding perspective, and also allows Galaxy to retain 100% ownership should they choose. Secondly the USD 280m of cash massively strengthens Galaxy's already strong balance sheet which de-risks the Company as a whole.

The magic of the POSCO deal for Galaxy and Galaxy shareholders is that the Sal De Vida project economics are not affected, SDV can still have a superb 40 year production life, and the Feasibility Study NPV of USD 1.48b is also completely unchanged. Clearly management at Galaxy has pulled another rabbit from their magical hat.

Given the deal is highly likely to go through investors have just a short window to get onboard before analysts upgrade their targets.

As usual all comments are welcome.

Trend Investing

Thanks for reading the article. If you want to go to the next level, sign up for Trend Investing, my Marketplace service. I share my best investing ideas and latest articles on the latest trends. You will also get access to exclusive CEO interviews and chat room access to me, and to other sophisticated investors. You can benefit from the hundreds of hours of work I've done to analyze the best opportunities in emerging industries, especially the electric vehicle and EV metals sector. You can learn more by reading "The Trend Investing Difference", "Recent Subscriber Feedback On Trend Investing", or sign up here.

My latest related Trend Investing articles are:

An Update On Pilbara Minerals Investing Well - July 2018 An Update On Cobalt Blue

Disclosure: I am/we are long GALAXY RESOURCES [ASX:GXY].

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information in this article is general in nature and should not be relied upon as personal financial advice.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Brink’s (NYSE:BCO) was downgraded by Zacks Investment Research from a “hold” rating to a “sell” rating in a research note issued to investors on Friday.

Brink’s (NYSE:BCO) was downgraded by Zacks Investment Research from a “hold” rating to a “sell” rating in a research note issued to investors on Friday.  Peter Krauth

Peter Krauth

Spok Holdings, Inc., through its subsidiary, Spok, Inc., provides various communications solutions to healthcare, government, and other enterprises in the United States, Europe, Canada, Australia, Asia, and the Middle East. The company provides one-way messaging, including numeric messaging services, which enable subscribers to receive messages comprising numbers, such as phone numbers; and alphanumeric messages, including numbers and letters that enable subscribers to receive text messages. It also offers two-way messaging services that enable subscribers to send and receive messages to and from other wireless messaging devices, such as pagers, personal digital assistants, and personal computers; and voice mail, personalized greeting, message storage and retrieval, and equipment loss and/or maintenance protection to one-way and two-way messaging subscribers. In addition, the company develops, sells, and supports enterprise-wide systems to automate, centralize, and standardize mission critical communications for contact centers, clinical alerting and notification, mobile communications, and messaging, as well as for public safety notifications. Further, it sells devices to resellers who lease or resell them to their subscribers; ancillary services, such as voicemail and equipment loss or maintenance protection, as well as provides a suite of professional services. The company serves businesses, professionals, management personnel, medical personnel, field sales personnel and service forces, members of the construction industry and construction trades, real estate brokers and developers, sales and services organizations, specialty trade organizations, manufacturing organizations, and government agencies. The company was formerly known as USA Mobility, Inc. and changed its name to Spok Holdings, Inc. in July 2014. Spok Holdings, Inc. is headquartered in Springfield, Virginia.

Spok Holdings, Inc., through its subsidiary, Spok, Inc., provides various communications solutions to healthcare, government, and other enterprises in the United States, Europe, Canada, Australia, Asia, and the Middle East. The company provides one-way messaging, including numeric messaging services, which enable subscribers to receive messages comprising numbers, such as phone numbers; and alphanumeric messages, including numbers and letters that enable subscribers to receive text messages. It also offers two-way messaging services that enable subscribers to send and receive messages to and from other wireless messaging devices, such as pagers, personal digital assistants, and personal computers; and voice mail, personalized greeting, message storage and retrieval, and equipment loss and/or maintenance protection to one-way and two-way messaging subscribers. In addition, the company develops, sells, and supports enterprise-wide systems to automate, centralize, and standardize mission critical communications for contact centers, clinical alerting and notification, mobile communications, and messaging, as well as for public safety notifications. Further, it sells devices to resellers who lease or resell them to their subscribers; ancillary services, such as voicemail and equipment loss or maintenance protection, as well as provides a suite of professional services. The company serves businesses, professionals, management personnel, medical personnel, field sales personnel and service forces, members of the construction industry and construction trades, real estate brokers and developers, sales and services organizations, specialty trade organizations, manufacturing organizations, and government agencies. The company was formerly known as USA Mobility, Inc. and changed its name to Spok Holdings, Inc. in July 2014. Spok Holdings, Inc. is headquartered in Springfield, Virginia. Public Joint-Stock Company Mobile TeleSystems provides telecommunication services in Russia, Ukraine, Turkmenistan, and Armenia. The company operates through three segments: Russia Convergent, Moscow Fixed Line, and Ukraine. It offers voice and data transmission, Internet access, pay TV, and various value added services through wireless and fixed lines, as well as sells equipment, accessories, and handsets. The company also provides system integration services and IT solutions. Public Joint-Stock Company Mobile TeleSystems has a partnership agreement with Nokia for joint development and deployment of Nokia's new technological solutions, as well as to promote new digital products and services of Mobile TeleSystems Group. The company was founded in 1993 and is based in Moscow, Russia. Public Joint-Stock Company Mobile TeleSystems is a subsidiary of Sistema Finance S.A.

Public Joint-Stock Company Mobile TeleSystems provides telecommunication services in Russia, Ukraine, Turkmenistan, and Armenia. The company operates through three segments: Russia Convergent, Moscow Fixed Line, and Ukraine. It offers voice and data transmission, Internet access, pay TV, and various value added services through wireless and fixed lines, as well as sells equipment, accessories, and handsets. The company also provides system integration services and IT solutions. Public Joint-Stock Company Mobile TeleSystems has a partnership agreement with Nokia for joint development and deployment of Nokia's new technological solutions, as well as to promote new digital products and services of Mobile TeleSystems Group. The company was founded in 1993 and is based in Moscow, Russia. Public Joint-Stock Company Mobile TeleSystems is a subsidiary of Sistema Finance S.A. News stories about Norbord (NYSE:OSB) have been trending somewhat positive recently, according to Accern. Accern identifies negative and positive media coverage by analyzing more than twenty million news and blog sources in real-time. Accern ranks coverage of publicly-traded companies on a scale of negative one to one, with scores closest to one being the most favorable. Norbord earned a daily sentiment score of 0.05 on Accern’s scale. Accern also assigned news articles about the construction company an impact score of 45.5014696096595 out of 100, indicating that recent media coverage is somewhat unlikely to have an impact on the company’s share price in the immediate future.

News stories about Norbord (NYSE:OSB) have been trending somewhat positive recently, according to Accern. Accern identifies negative and positive media coverage by analyzing more than twenty million news and blog sources in real-time. Accern ranks coverage of publicly-traded companies on a scale of negative one to one, with scores closest to one being the most favorable. Norbord earned a daily sentiment score of 0.05 on Accern’s scale. Accern also assigned news articles about the construction company an impact score of 45.5014696096595 out of 100, indicating that recent media coverage is somewhat unlikely to have an impact on the company’s share price in the immediate future.  Johnson Matthey (LON:JMAT) had its price target boosted by Berenberg Bank from GBX 3,680 ($48.99) to GBX 4,300 ($57.25) in a research report sent to investors on Tuesday morning. They currently have a buy rating on the stock.

Johnson Matthey (LON:JMAT) had its price target boosted by Berenberg Bank from GBX 3,680 ($48.99) to GBX 4,300 ($57.25) in a research report sent to investors on Tuesday morning. They currently have a buy rating on the stock. Wall Street analysts expect Worthington Industries, Inc. (NYSE:WOR) to report sales of $935.34 million for the current quarter, according to Zacks Investment Research. Two analysts have provided estimates for Worthington Industries’ earnings. The highest sales estimate is $971.00 million and the lowest is $899.68 million. Worthington Industries posted sales of $845.34 million during the same quarter last year, which would indicate a positive year over year growth rate of 10.6%. The firm is expected to announce its next earnings report on Wednesday, June 27th.

Wall Street analysts expect Worthington Industries, Inc. (NYSE:WOR) to report sales of $935.34 million for the current quarter, according to Zacks Investment Research. Two analysts have provided estimates for Worthington Industries’ earnings. The highest sales estimate is $971.00 million and the lowest is $899.68 million. Worthington Industries posted sales of $845.34 million during the same quarter last year, which would indicate a positive year over year growth rate of 10.6%. The firm is expected to announce its next earnings report on Wednesday, June 27th. Flinton Capital Management LLC boosted its position in Gap Inc (NYSE:GPS) by 182.3% during the first quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 225,148 shares of the apparel retailer’s stock after buying an additional 145,404 shares during the quarter. Flinton Capital Management LLC owned approximately 0.06% of GAP worth $7,025,000 as of its most recent filing with the SEC.

Flinton Capital Management LLC boosted its position in Gap Inc (NYSE:GPS) by 182.3% during the first quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 225,148 shares of the apparel retailer’s stock after buying an additional 145,404 shares during the quarter. Flinton Capital Management LLC owned approximately 0.06% of GAP worth $7,025,000 as of its most recent filing with the SEC.  Hercules Capital, Inc., formerly known as Hercules Technology Growth Capital, Inc., is a business development company specializing in providing venture debt, debt, senior secured loans, and growth capital to privately held venture capital-backed companies at all stages of development from startups, to expansion stage including select publicly listed companies and select special opportunity lower middle market companies that require additional capital to fund acquisitions, recapitalizations and refinancing and established-stage companies. The firm provides growth capital financing solutions for capital extension; management buy-out and corporate spin-out financing solutions; company, asset specific, or intellectual property acquisition financing; convertible, subordinated and/or mezzanine loans; domestic and international corporate expansion; vendor financing; revenue acceleration by sales and marketing development, and manufacturing expansion. It provides asset-based financing with a focus on cash flow; accounts receivable facilities; equipment loans or leases; equipment acquisition; facilities build-out and/or expansion; working capital revolving lines of credit; inventory. The firm also provides bridge financing to IPO or mergers and acquisitions or technology acquisition; dividend recapitalizations and other sources of investor liquidity; cash flow financing to protect against share price volatility; competitor acquisition; pre-IPO financing for extra cash on the balance sheet; public company financing to continue asset growth and production capacity; short-term bridge financing; and strategic and intellectual property acquisition financings. It also focuses on customized financing solutions, seed, startups, early stage, emerging growth, mid venture, and late venture financing. The firm invests primarily in structured debt with warrants and, to a lesser extent, in senior debt and equity investments. The firm generally seeks to invest in companies that have been operating for at least six to 12 months prior to the date of their investment. It prefers to invest in technology, energy technology, sustainable and renewable technology, and life sciences. Within technology the firm focuses on advanced specialty materials and chemicals; communication and networking, consumer and business products; consumer products and services, digital media and consumer internet; electronics and computer hardware; enterprise software and services; gaming; healthcare services; information services; business services; media, content and information; mobile; resource management; security software; semiconductors; semiconductors and hardware; and software sector. Within energy technology, it invests in agriculture; clean technology; energy and renewable technology, fuels and power technology; geothermal; smart grid and energy efficiency and monitoring technologies; solar; and wind. Within life sciences, the firm invests in biopharmaceuticals; biotechnology tools; diagnostics; drug discovery, development and delivery; medical devices and equipment; surgical devices; therapeutics; pharma services; and specialty pharmaceuticals. It also invests in educational services. The firm invests primarily in United States based companies and considers investment in the West Coast, Mid-Atlantic regions, Southeast and Midwest; particularly in the areas of software, biotech and information services. It invests generally between $1 million to $40 million in companies with revenues of $10 million to $200 million, generating EBITDA of $2 million to $15 million, focused primarily on business services, communications, electronics, hardware, and healthcare services. The firm invests primarily in private companies but also have investments in public companies. For equity investments, the firm seeks to represent a controlling interest in its portfolio companies which may exceed 25% of the voting securities of such companies. The firm seeks to invest a limited portion of its assets in equipment-based loans to early-stage prospective portfolio companies. These loans are generally for amounts up to $3 million but may be up to $15 million for certain energy technology venture investments. The firm allows certain debt investments have the right to convert a portion of the debt investment into equity. It also co-invests with other private equity firms. The firm seeks to exit its investments through initial public offering, a private sale of equity interest to a third party, a merger or an acquisition of the company or a purchase of the equity position by the company or one of its stockholders. The firm has structured debt with warrants which typically have maturities of between two and seven years with an average of three years; senior debt with an investment horizon of less than three years; equipment loans with an investment horizon ranging from three to four years; and equity related securities with an investment horizon ranging from three to seven years. Hercules Capital, Inc. was founded in December 2003 and is based in Palo Alto, California with additional offices in Hartford, Connecticut; Boston, Massachusetts; Elmhurst, Illinois; Santa Monica, California; McLean, Virginia; New York, New York; Radnor, Pennsylvania; and Washington, District of Columbia.

Hercules Capital, Inc., formerly known as Hercules Technology Growth Capital, Inc., is a business development company specializing in providing venture debt, debt, senior secured loans, and growth capital to privately held venture capital-backed companies at all stages of development from startups, to expansion stage including select publicly listed companies and select special opportunity lower middle market companies that require additional capital to fund acquisitions, recapitalizations and refinancing and established-stage companies. The firm provides growth capital financing solutions for capital extension; management buy-out and corporate spin-out financing solutions; company, asset specific, or intellectual property acquisition financing; convertible, subordinated and/or mezzanine loans; domestic and international corporate expansion; vendor financing; revenue acceleration by sales and marketing development, and manufacturing expansion. It provides asset-based financing with a focus on cash flow; accounts receivable facilities; equipment loans or leases; equipment acquisition; facilities build-out and/or expansion; working capital revolving lines of credit; inventory. The firm also provides bridge financing to IPO or mergers and acquisitions or technology acquisition; dividend recapitalizations and other sources of investor liquidity; cash flow financing to protect against share price volatility; competitor acquisition; pre-IPO financing for extra cash on the balance sheet; public company financing to continue asset growth and production capacity; short-term bridge financing; and strategic and intellectual property acquisition financings. It also focuses on customized financing solutions, seed, startups, early stage, emerging growth, mid venture, and late venture financing. The firm invests primarily in structured debt with warrants and, to a lesser extent, in senior debt and equity investments. The firm generally seeks to invest in companies that have been operating for at least six to 12 months prior to the date of their investment. It prefers to invest in technology, energy technology, sustainable and renewable technology, and life sciences. Within technology the firm focuses on advanced specialty materials and chemicals; communication and networking, consumer and business products; consumer products and services, digital media and consumer internet; electronics and computer hardware; enterprise software and services; gaming; healthcare services; information services; business services; media, content and information; mobile; resource management; security software; semiconductors; semiconductors and hardware; and software sector. Within energy technology, it invests in agriculture; clean technology; energy and renewable technology, fuels and power technology; geothermal; smart grid and energy efficiency and monitoring technologies; solar; and wind. Within life sciences, the firm invests in biopharmaceuticals; biotechnology tools; diagnostics; drug discovery, development and delivery; medical devices and equipment; surgical devices; therapeutics; pharma services; and specialty pharmaceuticals. It also invests in educational services. The firm invests primarily in United States based companies and considers investment in the West Coast, Mid-Atlantic regions, Southeast and Midwest; particularly in the areas of software, biotech and information services. It invests generally between $1 million to $40 million in companies with revenues of $10 million to $200 million, generating EBITDA of $2 million to $15 million, focused primarily on business services, communications, electronics, hardware, and healthcare services. The firm invests primarily in private companies but also have investments in public companies. For equity investments, the firm seeks to represent a controlling interest in its portfolio companies which may exceed 25% of the voting securities of such companies. The firm seeks to invest a limited portion of its assets in equipment-based loans to early-stage prospective portfolio companies. These loans are generally for amounts up to $3 million but may be up to $15 million for certain energy technology venture investments. The firm allows certain debt investments have the right to convert a portion of the debt investment into equity. It also co-invests with other private equity firms. The firm seeks to exit its investments through initial public offering, a private sale of equity interest to a third party, a merger or an acquisition of the company or a purchase of the equity position by the company or one of its stockholders. The firm has structured debt with warrants which typically have maturities of between two and seven years with an average of three years; senior debt with an investment horizon of less than three years; equipment loans with an investment horizon ranging from three to four years; and equity related securities with an investment horizon ranging from three to seven years. Hercules Capital, Inc. was founded in December 2003 and is based in Palo Alto, California with additional offices in Hartford, Connecticut; Boston, Massachusetts; Elmhurst, Illinois; Santa Monica, California; McLean, Virginia; New York, New York; Radnor, Pennsylvania; and Washington, District of Columbia. Solar Senior Capital Ltd. is a closed-end, externally managed, non-diversified management investment company. The Company’s investment objective is to seek to maximize current income consistent with the preservation of capital. The Company seeks to achieve its investment objective by directly and indirectly investing in senior loans, including first lien, unitranche, and second lien debt instruments, made to private middle-market companies whose debt is rated below investment grade, which it refers to collectively as senior loans. It may also invest in debt of public companies that are thinly traded or in equity securities. Under normal market conditions, at least 80% of the value of its net assets (including the amount of any borrowings for investment purposes) will be invested in senior loans. It invests in privately held the United States middle-market companies. Its investment activities are managed by Solar Capital Partners, LLC (Solar Capital Partners or the Investment Advisor).

Solar Senior Capital Ltd. is a closed-end, externally managed, non-diversified management investment company. The Company’s investment objective is to seek to maximize current income consistent with the preservation of capital. The Company seeks to achieve its investment objective by directly and indirectly investing in senior loans, including first lien, unitranche, and second lien debt instruments, made to private middle-market companies whose debt is rated below investment grade, which it refers to collectively as senior loans. It may also invest in debt of public companies that are thinly traded or in equity securities. Under normal market conditions, at least 80% of the value of its net assets (including the amount of any borrowings for investment purposes) will be invested in senior loans. It invests in privately held the United States middle-market companies. Its investment activities are managed by Solar Capital Partners, LLC (Solar Capital Partners or the Investment Advisor).